Through NetSuite’s seamless integration capabilities, simplify and create more efficient banking transactions and reconciliations. With NetSuite’s bank integration, businesses can enjoy greater efficiency and cost savings across the board.

Purpose of Bank Integration and Reconciliation

| Challenges | Bank Integration Features | ||

| 1 | Prone to Human Error | Increased risk of mistakes and inaccurate payments through the manual entry of data. | Error Free environment |

| 2 | Bank Mismatch | Missing Transactions due to human error. | Updated Bank |

| 3 | Operating hours dependent | With Manual process the transactions can be done only at working Hours | Independent Operating hours |

| 4 | Security Concerns | Increased risk of fraudulent activity with little to no control over who is making a payment, or the accuracy of a payment. | Secured |

| 5 | Human Resource cost | Increased Human resource cost | Minimum Human Resources |

| 7 | incompatible payment files | Generated payment file compatibility | Automated Payment |

| 8 | Manual Reporting | Reports needs to be generated manually. | Report Automation |

| 9 | Affect efficiency | Manually logging in and making payments is time intensive and a tedious manual task for a finance professional. | Increased Efficiency |

| 10 | Manual Reconciliation | Due to human error sometimes wrong transactions get reconciled | Error free Automated Reconciliation |

Bank Feed

NetSuite Provides Bank feed process for seamless automation of payment and receipt for Some banks for different countries, Which can be integrated with NetSuite with Minimum effort.

Bank Feed process is available for following countries.

| United States | Malaysia |

| Australia | New Zealand |

| Canada | Philippines |

| Countries in Europe (includes United Kingdom) | Singapore |

| Hong Kong | Thailand |

| Indonesia |

Supported Financial Institution Account Types

| U.S. and Canada | PSD2 Compliant Countries Within Europe | Non-PSD2 Compliant Countries Within Europe (Switzerland) | Other Countries (Australia, New Zealand, Hong Kong, Indonesia, Malaysia, Philippines, Singapore, and Thailand) |

| Checking | Payment Accounts (Credit Card, Debit Card, and Ewallet) | Payment Accounts (Credit Card, Debit Card, and Ewallet) | Payment Accounts (Credit Card, Debit Card, and Ewallet) |

| Savings | Bank Deposit Accounts (Savings and Checking) | Bank Deposit Accounts (Savings and Checking) | Bank Deposit Accounts (Savings and Checking) |

| Credit Card | Amex Card | N/A | N/A |

Important Notes

- Bill should be approved to process the payment.

- After getting the payment advice from bank, the actual transaction gets posted with all the detail

- No financial impact till the payment advice is received by the bank

Any additional requirements and/or customizations, not mentioned in the scope will constitute a ‘Change Request’ or may lead to revise this proposal.

Bank Integration

For Indian Banks NetSuite facilitates integration with some custom Codes

inoday has delivered integration with Major Banks like ICICI Bank, Yes Bank , Kotak Bank and HDFC Bank using Custom Codes for AR & AP Processes Both as follows.

Needless to say, inoday, an official, #1 ORACLE NetSuite Channel Partner, has delivered integration with Major Banks like ICICI Bank, Yes Bank , Kotak Bank and HDFC Bank using Custom Codes for AR & AP Processes Both as follows.

| Sr. No. | Accounts Payables | Accounts Receivables |

| 1 | Pre Payment | Credit Card Payments |

| 2 | Vendor Bill Payments | POS Payments |

| 3 | Journal | Recurring Receivables |

| 4 | Tax Payments | Customer Payments |

| 5 | Expenses Payments |

Important Notes

- Bill should be approved to process the payment.

- After getting the payment advice from bank, the actual transaction gets posted with all the detail

- No financial impact till the payment advice is received by the bank

Any additional requirements and/or customizations, not mentioned in the scope will constitute a ‘Change Request’ or may lead to revise this proposal.

Bank Integration for Accounts Payable

Automate the vendor bill payment with Banks

Following transactions are required to besynchronized from NetSuite:

- Vendor Bill Payment

- Pre-payments

- Journal

Process and Sample screens are included in the Document.

Important Notes:

- Bill should be approved to process the payment.

- No financial impact till the payment advice is received by the bank

- After getting the payment advice from bank, the actual transaction gets posted with all the detail

Here, any additional requirements and/or customizations, not mentioned in the scope will constitute a ‘Change Request’ or may lead to revise this proposal.

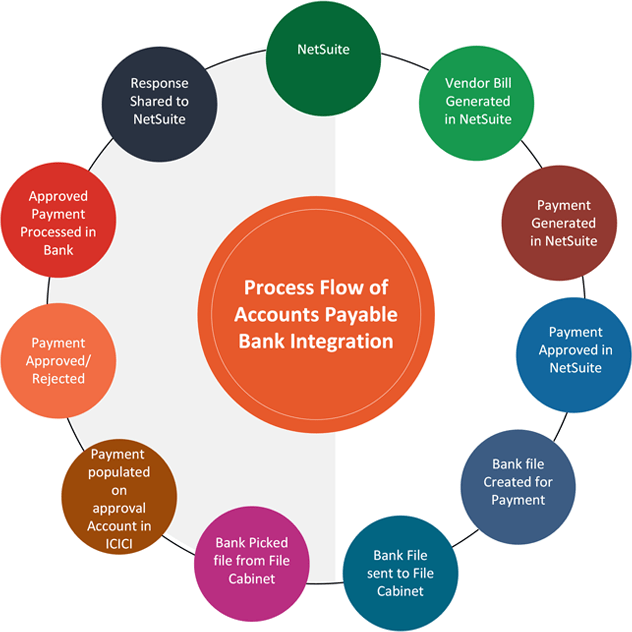

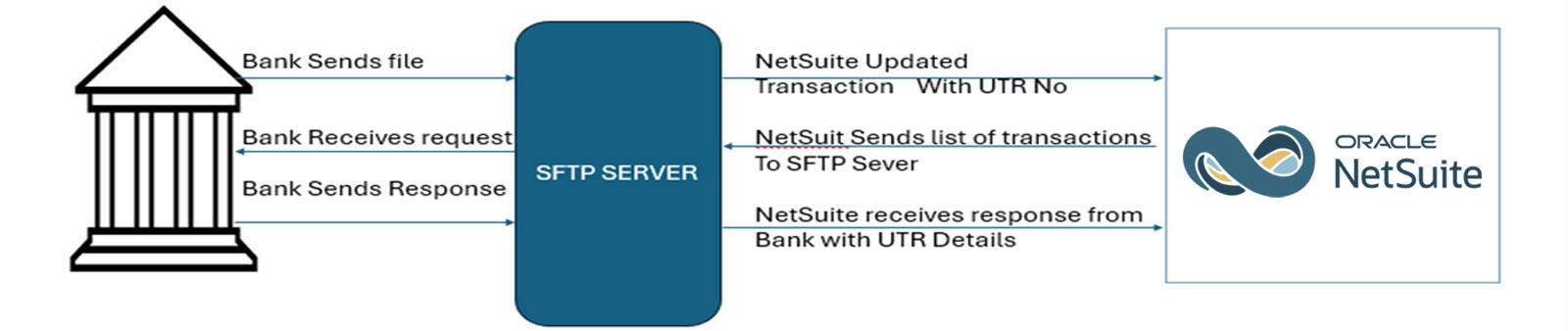

Process Flow of Accounts Payable Bank Integration

The process flow of accounts payable bank integration using NetSuite. It begins with the generation of a vendor bill in NetSuite, followed by payment generation and approval within NetSuite. Subsequently, a bank file is created and sent to a file cabinet, from where the bank retrieves the file. Upon approval, the payment is populated in the bank account (in this case, ICICI), after which the payment is processed by the bank. The final step involves sharing the response back to NetSuite, completing the cycle.

Eliminate Critical Banking Challenges and Get Integration-empowered Banking Efficiency

Businesses performing banking operations or banks can easily eliminate mission-critical issues by leveraging the power of the cloud. Here, bank reconciliation and integration help thriving businesses take a competitive lead and make the most of advanced technology solutions to enhance banking efficiency. Undeniably, when it comes to NetSuite Bank Integration and Reconciliation, it not only turns easily but productive to overcome obstacles and optimize outcomes.

Most Common Challenges with Banking Tasks

- Manual Process

- Duplicate Data Entry

- Security Risks

- Difficulty With Tax Compliance

- Delay in Payments

- Manual Reporting

Eliminating critical banking challenges through integration-empowered banking efficiency involves streamlining processes, reducing manual errors, and enhancing data accuracy. By integrating banking systems with financial management platforms like NetSuite, organizations can automate and synchronize accounts payable and receivable workflows. This integration ensures real-time updates, improves transaction visibility, and accelerates payment processing. Consequently, businesses can achieve higher operational efficiency, better compliance, and more effective financial management, leading to overall improved banking efficiency.

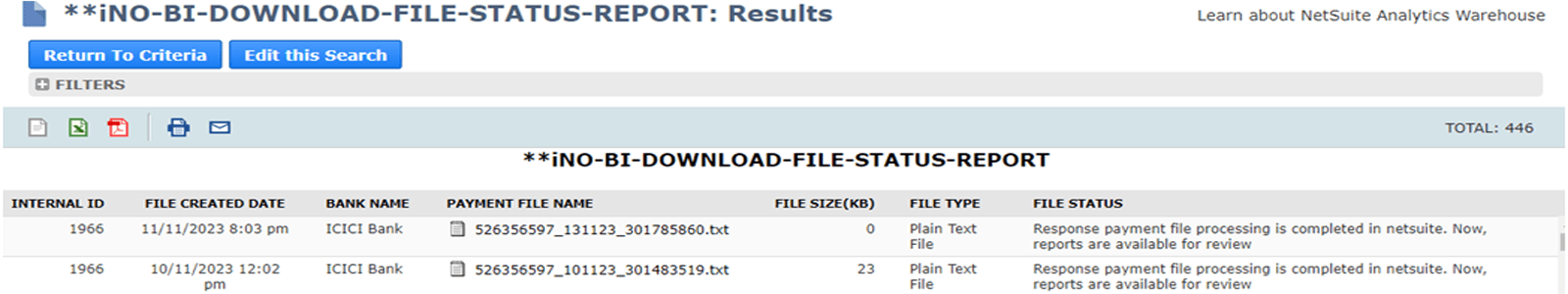

Maker Checker Process at Bank

Given these points, checker will approve the populated payment using internet Banking

Following transactions are required to be synchronized from NetSuite:

- Vendor Bill Payment

- Pre-payments

Note : A response will be shared by the bank after Maker checker process as following screen

Important Notes:

- Response received from the bank

- Now financial impact takes place as per the received response from the bank

- After getting the payment advice from bank, the actual transaction gets posted with all the detail

Any additional requirements and/or customizations, not mentioned in the scope will constitute a ‘Change Request’ or may lead to revise this proposal.

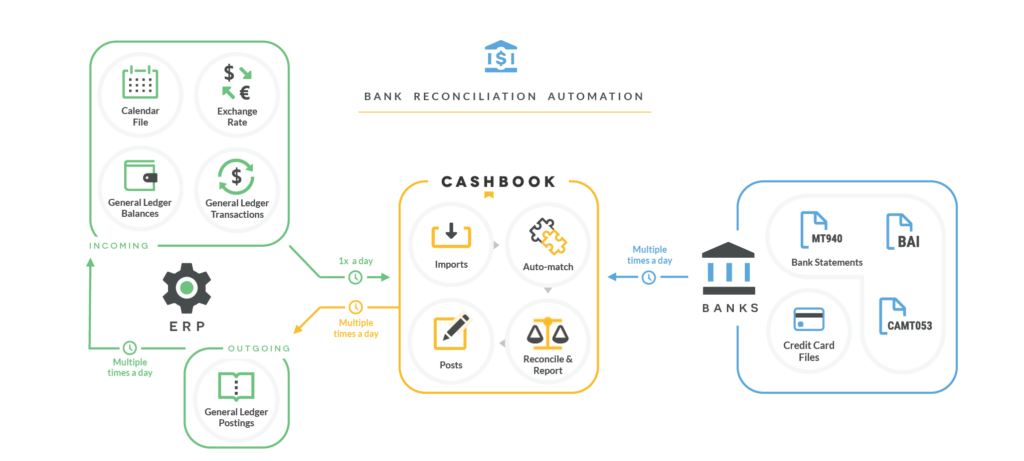

Auto Bank Reconciliation

Bank Reconciliation Automation

inoday has developed a reconciliation process for Indian Banks for seamless operations.

This bundle helps us to reconcile the data in one go for the multiple banks.

- In the case of Bank Integration inoday will use UTR to reconcile the data.

Note* Custom Records Terms implies Bank Statement Uploaded in NetSuite by Customer

Process:

- If bank integration is already done, in this case we will consider the transactions already having UTR Number updated on the respective transactions.

- Bank Data will be uploaded through our custom screen that inoday will provide. (User can upload multiple Bank Data in one go along with UTR in one CSV.) as Custom Records

- Custom Record will be used to store the Bank data.

Now, uploaded data will be matched with the transaction in NetSuite based on UTR number.

In case a few transactions are still not matched. Or UTR not updated on transactions.

Those data will be considered as unreconciled.

- A report will be provided on those unreconciled transactions.

Bank Statement needs to be uploaded in NetSuite (Custom Records). A Unique Internal ID will be created by NetSuite.

For the most part, through CSV – User will find the NetSuite transactions and update the Custom Records Intrenal ID on these unreconciled transactions.

Then these transactions will be reconciled automatically at backend.

NetSuite Standard Bank Reconciliation:

For the Auto Reconciliation process users must use the inoday process for the Bank payments: –

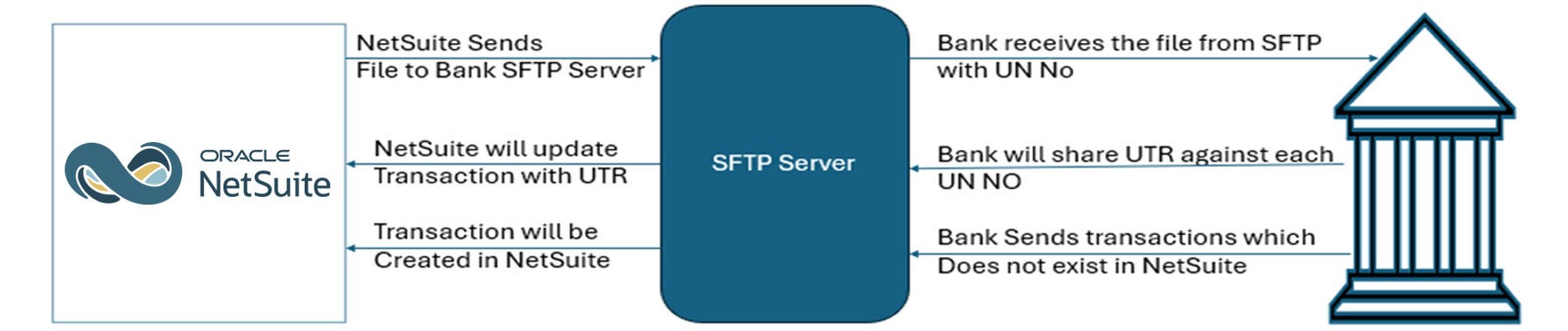

- inoday will offer a user-friendly interface that allows users to conveniently review and select transactions that need to be paid.

Users will be able to check or mark the specific transactions that need to be paid through this interface.

- When the user selects transactions. A Unique Number will be generated for that, like batch payment. Let’s say a unique NetSuite UN Number. E.g. Batch Payment Number

- The NetSuite UN number will be automatically updated on the selected transactions.

- Parallelly a saved search will be generated based on selected transactions (As Above Mentioned). User needs to Download this report need to be sent to bank along with unique NetSuite UN Number

Note* this report must be sent to the SFTP Sever for payments along with NetSuite UN Number only

- In the bank response, the bank will send the UTR against NetSuite UN Number.

- Customer will upload the Bank data through csv along with UTR and NetSuite UN Number.

- Reconciliation process will be run automatically bases on NetSuite UN Number

If the Bank statement has transactions. However, in NetSuite ERP these entries have not been created yet.

Bank Statement needs to be uploaded to NetSuite first.

This uploaded Bank data will be stored in custom records along with a unique internal/Custom ID.

For the reconciliation process, users must add the above unique Custom Internal ID on the respective transactions in NetSuite.

Now we have Bank Statement Data in Custom Records and we have also created entries in NetSuite.

Now on the base of have common unique id (custom Records internal Id) on both the records (NetSuite and Custom Records (Bank Statement)

Then based on unique custom records ID data will be reconciled.

Note* In case of unreconciled data users must add the unique custom record id to their respective transaction in NetSuite.

Reconciliation with Standard Approach

inoday helps customer to get the data from SFTP to NetSuite at “Match Bank Data” Page through Connectivity Plugin-in.

If there is already bank integration, then the UTR Number will be updated on NetSuite transactions. Hence, we can create the Reconciliation Rules. And with the help of reconciliation rules data will be matched/Cleared.

If there is no bank integration User need to manual match the transaction using match bank data and reconciled accordingly.

For more details, write to us at info@inoday.com Or Schedule A Demo