HR & Payroll Module for Business Central ends your search for a Full blown ERP for Small and Medium enterprise on Dynamics 365 platform. This HR & Payroll runs on Business Central platform as integrated module of Dynamics 365 BC and your all ERP users can access it with same credential.

inoday’s extensively orchestrated HR & Payroll Solution—NAVDPayRoll comes with integrated capabilities of SELF-SERVICE CENTER or better known as EMPLOYEE CENTER. Employees can manage their whereabouts (login, log out, break, leave) on their own, which business owners have access to anytime, anywhere. This inventive employee management solution can be procured by both the New and Old customers/users of Dynamics NAV as well as Dynamics 365 Business Central to handle their HR & Payroll.

NAVDPayRoll mandates with HR Compliance, where HR managers can control all operations efficiently, right from creating profiles and keeping the records to employee time tracking, calculating payroll for many employees, adding bonuses, cutting checks, and prompting post payments.

- It includes automatically up-to-date Tax Tables to help you meet complex regulatory compliance. Also, it supports the Indian Taxation system along with overseas regions efficiently.

- We have incorporated NAVDPAYROLL with built-in bank integration to help you pay your employees electronically. It comes with Bank-grade security to protect all your data as well.

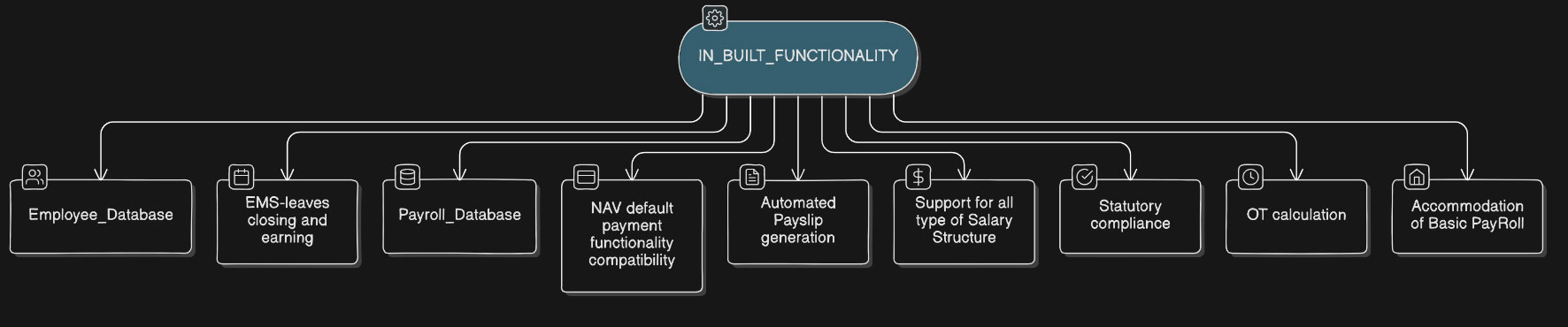

IN BUILT FUNCTIONALITY

- Employee database

- EMS-leaves closing and earning

- Payroll Database

- NAV default payment functionality compatibility

- Automated Payslip generation

- Support for all type of Salary Structure

- Statutory compliance

- OT calculation

- Accommodation of Basic PayRoll, Reimbursements, Loans, Incentives, and Advances

Taxable Benefits

On the behalf of the employer’s organizations, NAVDPayRoll prompts

Calculation and deduction of applicable taxes on taxable benefits

- TDS-. NAVDPayRoll entails automation in deducting tax (on income, dividends, or asset sales) due before paying the balance to the payee.

- EPF – EPF or Employee’s Provident Fund is 12 percent of the deduction from salary going to the provident fund, according to the EPF rules. Also, your company requires contributing the same 12 percent.

- ESIC- NAVDPayRoll helps mandate Employee’s State Insurance compliance and make the most of this self-financing social security and health scheme in terms of medical care for self and family from ESI hospitals or dispensaries and vocational training for upgrading skills along with fee and traveling allowance.

Settlement for both employee’s and employer’s shares of taxes to tax collecting body as well as, remitting employer’s premiums

- Tax Filing— It extends assistance for the tax filing process, where it reminds tax deadlines to ensure filing on time and avoid incurring penalties.

- Tax Exemption Processing— NAVDPayRoll is extensively capable of handling tax exemptions processing and management.

Reports the taxable benefits on the employee’s tax slip

NAVDPayRoll comes up with the ability to analyze the data input into your system, help spot patterns, and generate reports.

NEXT MOTION

- Mobile app connectivity

- Web based EMS

With NAVDPayRoll, specifically orchestrated HR & Payroll software solution by inoday, your payroll professional can perform everything in a single step.

inoday, being an accredited Microsoft Partner, believes that eliminating HR accounting and Payroll management bottlenecks can steer holistic organizational improvement. Irrespective of your business size, a well-managed workforce would drive you unprecedented growth and increased productivity.

For more queries around HR & Payroll, connect with our dedicated team at info@inoday.com Or Schedule a Demo