Considering challenges around taxation within Indian localization or India tax management with the introduction of GST Regime, inoday presents a customizable and scalable solution, NetSuite India Tax bundle to address GST, TDS, and TCS business requirements, which is based on the fundamentals of NetSuite SuiteTax.

inoday NetSuite India Tax Bundle

Tax Components available in India

- GST

- TDS

- TCS

Needless to say, inoday adapts NetSuite Tax Management capabilities to make its inventive features and functionalities in the form of India localization bundle NetSuite, appropriate for their customers‘ business requirements through our professional services. Moreover, many of our customers have simplified GST registration, opted for new GST registration, and GST filing as well.

GST AND TDS MANAGEMENT

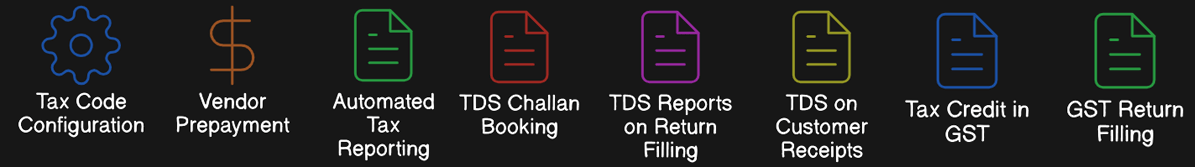

By leveraging NetSuite India Tax Automation via an official Oracle NetSuite Channel Partner can help you meet GST and TDS compliance and regulations efficiently.

VENDOR PREPAYMENT

Calculate TDS on Vendor, analyze bills and reports, and upload vendor bills efficiently within this NetSuite Tax Solution for India.

TDS CHALLAN BOOKING

You can book separate challan for separate sections, and vendors and create e-invoicing with automatically generated challan—all within NetSuite India Tax Structure.

VENDOR CREDIT (Debit Note)

TDS REPORTS ON RETURN FILING

Create TDS Reports for 26Q and 27Q in standard format for return filling and validation, and avail of SEZ reports in Excel/CSV format with NetSuite India Tax Bundle.

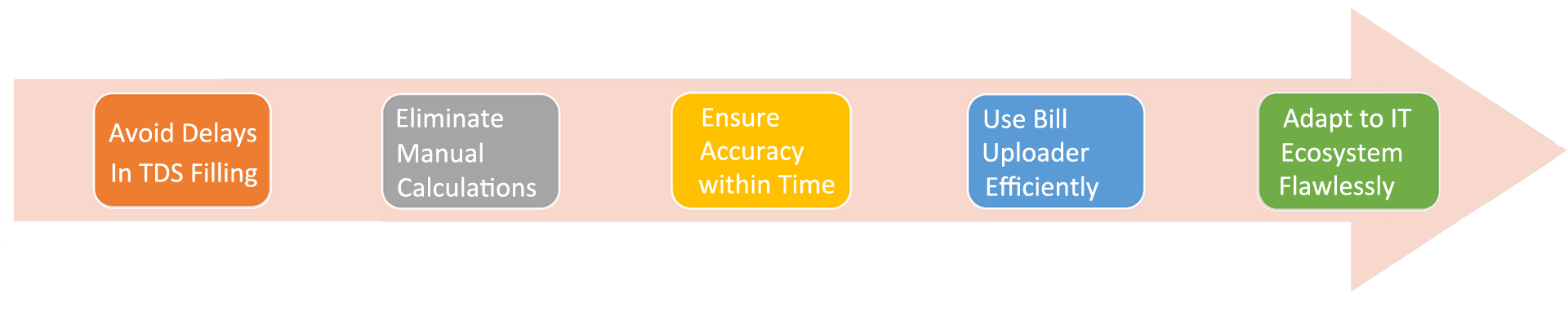

Mitigate Common TDS Challenges with inoday NetSuite India Tax Bundle

How Does inoday Tax Bundle help Bridge Taxation Gaps?

inoday Tax Bundle comes with

The benefits of the inoday NetSuite India Tax Bundle:

- Support for Multiple Types of Taxes:

– The inoday Tax Bundle, orchestrated on NetSuite Tax Management Capabilities, handles local taxes across subsidiaries, including GST, TDS, and TCS.

– Ideal for businesses with multiple subsidiaries or legal entities.

- Integrated Tax Management Solution:

– This one-stop solution integrates transaction tax determination and tax reporting within the suite.

– Business organizations can use it for sales, billing, revenue recognition, and payment processing.

- Indian Localization:

– The NetSuite India Tax Automation with the inoday India Tax Bundle automates tax determination specific to Indian law.

– Ensures the correct tax rate is applied to every transaction, every time, reducing guesswork.

- Enhanced Confidence for Teams:

– Accounting, purchasing, and sales teams can confidently process taxes in compliance with India-specific laws using the inoday NetSuite India Tax Bundle.

Why Choose inoday to meet your GST and TDS Requirements?

Acclaimed as the #1 Oracle NetSuite Channel Partner in India, inoday has come with India Tax Bundle to address GST and TDS requirements around Indian localization. This comprehensive and scalable inoday NetSuite Tax Engine is capable of automated tax reporting, offers seamless integration, and is GST compliant. With high flexibility across reporting, tax code configuration, and tax details capturing at both the customer and vendor site, this Indian Taxation Bundle for NetSuite solution renders TDS Support and helps growing businesses meet GST and TDS regulations without a hitch.

Acknowledged as an official and award-winning Oracle NetSuite Channel Partner, inoday is the right place to help you eliminate the business risk incurred due to manual data entry or tax calculation. We help you harness the power of the India localization Bundle in NetSuite for automated tax determination and complaince.

As certified NetSuite Consultants, we have delivered our expertise for 17+ years across business gap analysis, implementation, configuration, customization, integration, and managed services. inoday, an astute NetSuite Solution Provider can help you get inoday NetSuite India Tax Structure and ensure robust tax management.

You can connect to our experts to understand NetSuite India Tax Bundle and make the most out of our expertise across tax management solutions to add value to your business.

What Your Business Gets?

NetSuite Modules We Work

Our Clients

Frequently Asked Questions

What is TDS and how it works?

TDS or Tax Deducted at Source can be explained by the income tax reduced from the money paid at the time of making specified payments by the person making such payments. These may include rent, commission, professional fees, salary, or interest. In general, a person receiving income is liable to pay income tax.

What is the basic rule of TDS?

The fundamental concept of TDS is that the person on whom responsibility has been cast is to deduct tax from payments of specific nature at an appropriation rate. The deducted sum should be deposited to the credit of the Central Government later.

What are the tax features of NetSuite?

NetSuite Tax Management Features cover support for in-country transactions management such as sales tax, VAT or GST. Businesses can leverage NetSuite Tax Management to navigate special tax situations and rules like intra-country, country-to-country transaction, 3PL, reverse charges, and more.

What are tax groups in NetSuite?

A Tax Group combines multiple Tax Codes. To create a Tax Group in NetSuite, you can go to Accounting, Tax Group in your NetSuite account and create the Tax Group in NetSuite.

How do I create a tax invoice in NetSuite?

Go to Transactions > Sales > Create Invoices. Select the customer for this invoice. If the customer is from a nexus where withholding tax is used, the system reloads the form to display the withholding tax objects.