Table of Contents

E-invoicing

Problem 1 – Is E–invoicing available in NetSuite or not?

Solution- E-invoicing is not present in the base NetSuite, but inoday have a Built for NetSuite solution as SuiteApp for that.

This solution is meant to client specific. Based on rigorous analysis and subject matter expertise this solution is enabled with all the scenarios. And it’s well evaluated by our many satisfied customer.

inoday e-invoicing solution works for Regular, SEZ, and Overseas clients also. It can also be done with the already implemented projects. We just must set up the customization and add some fields on the invoice forms related to the E-invoicing.

Using inoday BFN E-invoice can be generated on single click of the button.

Let us explain some problem area and solution for the same.

Problem 2- Every client needs a separate print format for e-invoices.

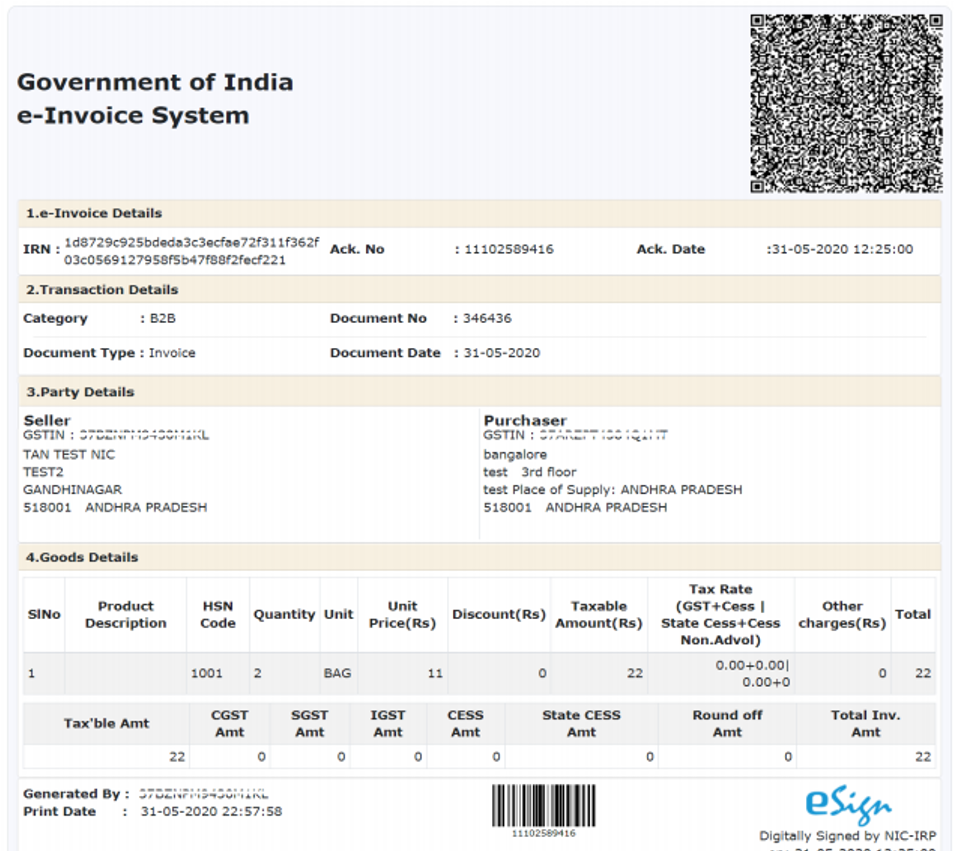

Solution –We have set up the base NetSuite print as per e-invoicing regulations.

Also sometimesthe client wants the setup, which is not correct as per the regulations, then we have the standard portal print of the invoice, so that the client make sure that they have to setup the print as per the norms.

We have set up the standard print Size for E-invoicing QR codes, so that it can be scanned by the users through a scanner.

We have added the scenario for separate print as per the supply type. For Regular customers, PAN, and GST details are printed on the sales invoices with E-invoice details.

For overseas clients, their terms and conditions and supply type are printed as with LUT or without LUT.

Problem 3- Demo E-invoicing account and testing.

Solution-The client always evaluates the demo e-invoices on the sandbox account. We have restrictions to do the demo e-invoicing. We always give training sessions and instructions to the users that how to evaluate their relevant scenarios for invoicing.

Users must incorporate Predefined demo GSTINs in their subsidiary master. Then they will be able to generate demo e-invoicing. These GSTINs are registered for demo invoicing testing.

For e-invoicing, NetSuite master and Api setup should be done as per the requirements. If the setup is not completed, then an error will be shown on the sales invoices.

Problem 4- E-invoicing for invoices having discounts.

Solution- E-invoicing is difficult when a discount scenario comes in. In that case, we will makea separate setup for discounts, so that system can generate the E-invoices with discounts.

Once all the setups are done, then major master-related errors come.

GST

Problem 1 – GST tax compliances issues

Solution- Oracle hasa GST bundle for Indian clients but that GST bundle does not fit with GST compliances.

We have customized the entries setup and reports as per the GST compliances under our natively orchestrated NetSuite India Tax Bundle. It follows GST setup into NetSuite, GST report into NetSuite, and GST on customer advance in NetSuite. Sales on RCM are not available in the Oracle Bundle.

We have customized the print voucher and reports for that. So that clients have sufficient information for their GSTR reports.

We have also added GL plugins for clients as per requirements and reports.

The main issue with the GST bundle is the report part. We have customized all the GSTR reports and done the entry-level setup according to that. Users can add or remove the columns as per their requirements.

We have covered those scenariosunder India localization Bundle NetSuite which are not currently available in the Oracle bundle.

Key issues with the GST bundle are related to the RCM and SEZ vendors.

For SEZ vendors, all purchases will be treated as interstate purchases, but it is not available in the bundle. We have added the plugin to change the GL impact and report to be shown.

Problem 2 – One HSN can have more than onetax rate.

Solution-The system has set up for GST that, one HSN can have different rates on sales and purchases transactions. But it cannot have more than one rate on sales or purchase transactions.

For this, we have found the solution of having multiple HSNs for different rates, but on voucher print, only HSN will be printed.

Problem 3 – Eligibility of Input is not available mentioned on the voucher.

Solution-One HSN can be eligible for input with one vendor and cannot be eligible for input with another.

For this, we have done customization of selecting the option of eligibility of input tax, so that clients have clear reports for eligible transactions. With this customization, clients can use the reports for GSTR 2B reconciliation.

Problem 4– Errors coming on transactions due to incomplete setups.

Solution-Sometimes on saving on vouchers, errors come on the top of the voucher and the voucher gets stuck there. These types of errors come due to incomplete setup or missing mandatory fields on the Vendor, customer, and item masters.

This can be avoided with the sanity check of masters and tax rate rules.Also, similar types of error can have the same solution.

Problem 5- Calculation of GST in case of Discount.

Solution-There are multiple setups of invoices and vendor bills having discounts mentioned.

In invoices, discounts can be related to one item or specific items, or they can be applied to whole invoices.

In that case, we need to enter the voucher as per the following method.

- Discount is applied to all items– In that case, the separate field for discount is mentioned on the voucher on which the user can define the discount item and rate. In proportion to the item amount, a discount will be applied to all items.

- Discount is applied to a specific item– In that case, the discount item is entered just below the related item, then the discount will be applied to only that item.

To manage GST and TDS issues and get E-invoicing capabilities, write to us at info@inoday.com Or Schedule A Demo