Table of Contents

Summary:This write-up talks about NetSuite Accounts Reconciliation, which helps businesses reconciliate faster and with accuracy to ensure robust financial management. Additionally, NetSuite Bank reconciliation shares insights on the features, benefits, and ways that thriving businesses can leverage to drive automation with standardization.

NetSuite Account Reconciliation Software

With the deployment of NetSuite Account Reconciliation software, businesses can drive automation around general ledger account reconciliations.

These include

- Bank Reconciliations

- Credit Card Matching

- Intercompany Transactions

- Account Receivables and Payables

- Invoice-To-Po Matching, all in a centralized and integrated workspace.

By leveraging the fundamental capabilities of NetSuite Account Reconciliation, you can remove errors and manual ticking and tying and empower your accounting teams to focus on exceptions, high-risk reconciliations, and other strategic business activities.

Standardize Reconciliation

Account reconciliation assists in eliminating time spent downloading data from source systems and aggregating details in spreadsheets. Also, you can bid farewell to manual reviewing of account balances, and using complex formulas to match, and reconcile.

Control and Visibility

NetSuite ERP allows you to view the status of all reconciliations in one, unified place. You get real-time dashboards and purpose-built reports to gain extensive visibility into the reconciliation status of each account. For the most part, it shows preparers, reviewers, and sign-off dates.

NetSuite Account Reconciliation Software Benefits

- Faster Financial Closure— Business administrators can standardize and automate account reconciliations, and transaction matching.

- Expedited Transaction Matching— You get fully automated time-consuming, repetitive reconciliations, such as zero-balance, low-value, or low-risk reconciliations as per the rules you set.

- Consolidated Internal Controls and SOX Compliance— Finance managers can easily access archived e-copies of supporting documentation at the account level.

- Accurate Financial Statement Accuracy—This helps reconcile GL accounts to catch all kinds of discrepancies or omissions in financial records and reduce the risk of financial misstatements.

- Single, Unified Solution— You can manage and view the status and details of each account with balance comparisons, preparers, reviewers, and sign-off dates.

NetSuite Account Reconciliation Features

Close Management

NetSuite Account Reconciliation enables you to close your books faster and with more accuracy by managing and monitoring every aspect of it.

- Scheduling— It allows you to assign tasks and ensure their execution in the proper sequence.

- Monitoring— You can access the status of every close task and its dependencies from a single, unified dashboard. It gives you the ability to drill down by user to identify mission-critical issues.

- Workflow— Business administrators can simplify the financial closure process with pre-built customizable workflows. For the most part, it automates task assignments, data validation, approval routing, and notifications.

- Automated Calendars— Calendars automatically roll forward from the prior-year reporting and it readily eliminates the need for manual adjustments.

Reconciliation Compliance

Businesses in the finance industry or struggling with managing finance can ensure reconciled accounts using the correct format. Also, they can go with complete justification and logic behind any adjusting entries. For the most part, this keeps the entire team on track with an approval workflow that captures evidence of signoffs, and email notifications.

- Automated Reconciliations—You can avail of direct integration with NetSuite transactions that allow you to further automate reconciliations for bank accounts, credit card transactions, intercompany transactions, accounts payable, and accounts receivable. Additionally, you get the ability to drill back to NetSuite ERP and easily address any reconciling items.

- Flexible Templates— Businesses can get started quickly using pre-built formats based on best, industry-centric practices or create custom formats to meet your unique requirements.

- Audit Support and Compliance— When you get a secure document repository, it ascertains that reconciliations are not altered or lost, and it rendersglobal auditability. Also, you can audit evidence for reconciliations and log into the application to meet your compliance needs.

- Flux Analysis—It renders an explanation for balance changes over a given period—month-over-month, quarter-over-quarter, or year-over-year comparison.

Transaction Matching

NetSuite ERP offering extensive Account Reconciliation helps drive automation across transaction matching. It readily supports balance comparison reconciliation processes, including intercompany, sub-ledger, credit card, and bank reconciliations. For the most part, you get operational and compliance dashboards that reflectcomplete, open, or late reconciliations and list the responsible party as well as variance details and commentary.

- High-volume Transactional Reconciliations— You can make the most of an auto-match engine that matches millions of transactions in minutes and integrates directly with period-end reconciliations.

- Auto-suggested Matching— Businesses leveraging the intelligent auto-match feature expedite the transaction-matching process as it suggests matches that you can accept or discard.

- Matching Rules—You cancreate flexible matching rules for individual transactions or groups of transactions.

- Complex Reconciliations—The finance manager can get unlimited data sources and define unlimited attributes per data source to support the most complex reconciliations.

Implementing Account Reconciliation and Transaction Matching in NetSuite

Implementing account reconciliation and transaction matching automation in NetSuite needs careful planning and execution.

Business Requirements Assessment

You should understand the specific account reconciliation and transaction matching needs of your organization before you go for NetSuite Account Reconciliation. This involves the evaluation of existing processes, identification of pain points, and defining desired business outcomes.

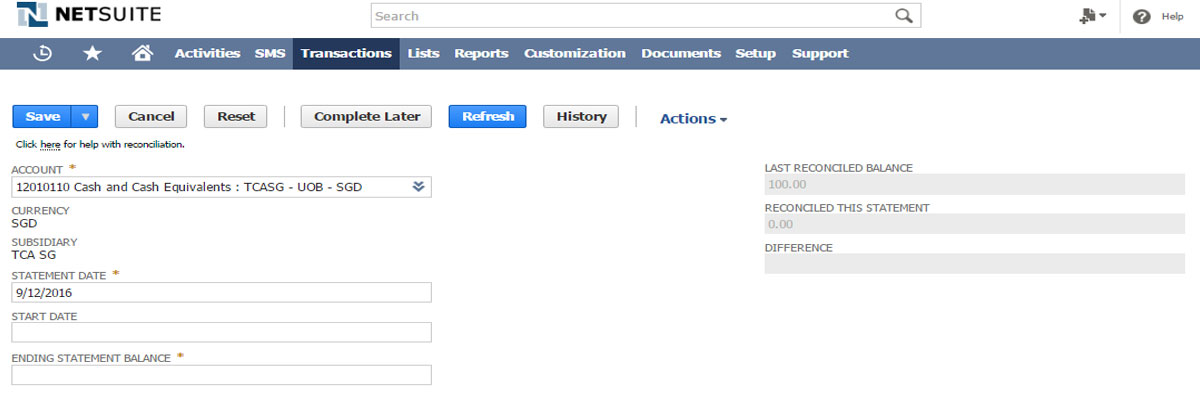

NetSuite’s Reconciliation Configuration

NetSuite ERP renders dedicated modules for account reconciliation and transaction matching. Also, you can configure these modules that involve setting up matching rules, mapping data sources, defining workflows, and integrating external systems.

Data Migration and Testing

Migration of historical data ensures data integrity and conducts comprehensive testing to strengthen the entire implementation process. For the most part, it ensures a smooth transition of automated account reconciliation and transaction matching in NetSuite.

Why inoday?

At inoday, an official, globally accredited, and #1 ORACLE NetSuite Channel Partner, you can connect to certified and highly skilled NetSuite Consultants. These experts help you with 16+ years of experience and expertise in driving Digital Transformation via Cloud Computing Solutions.

We deliver industry standard-based practices, a proven methodology, and in-depth knowledge across NetSuite Account Reconciliation that has helped many businesses like yours scale up and lead a competitive edge. Additionally, our willingness to take up challenges, our approach to solving bottlenecks, and our support even beyond the implementation lifecycle have helped these businesses sustain their scalability and be future-ready with adaptable solutions.

FAQs

What is NetSuite account reconciliation?

NetSuite Account Reconciliation software drives automation across general ledger account reconciliations, including bank reconciliations, credit card matching, intercompany transactions, account receivables and payables, and invoice-to-PO matching.

What are the types of reconciliation?

The different types of reconciliation can be named as

- Bank reconciliation

- Vendor reconciliation

- Customer reconciliation

- Business-specific reconciliation

What is the process of account reconciliation?

Account reconciliation stands for comparing general ledger accounts for the balance sheet with supporting documents like bank statements and sub-ledgers.

For more details, write to us at info@inoday.com Or Schedule A Demo