GST stands for Goods and Services Tax, a comprehensive and destination-based tax levied on manufacture, supply, sales, and consumption of goods and services at a national level. It is introduced to integrate the entire country into a uniform tax rate and improve economic growth holistically. This year, Business Central has included the GST feature to Indian localization to support thriving businesses that manage taxation efficiently along with business automation.

SPOTLIGHT

The India Localization features in Microsoft Dynamics 365 Business Central cover GST, TDS, TCS, and Voucher Interface to help business organizations meet local financial and legal requirements efficiently.

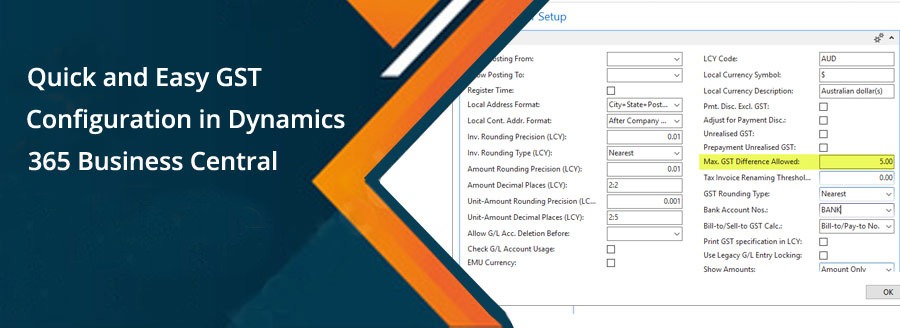

Configuring GST in Dynamics 365 Business Central will help companies to calculate and record GST amounts on inward and outward supplies. Additionally, it rendering and expanding the scope for GST credit adjustments and GST settlements. Business Central allows you to export GST reports from your system across different formats for analysis as well.

Setting Up GST in Dynamics 365 Business Central

| After choosing Search icon, enter Tax Type > GST > Action > Tax Rates You can choose the related link and fill in the fields including HSN/SAC Code, GST Group Code, Vendor State Code, Location State Code, Date (From, To), SGST%, CGST%, IGST%, Cess%, KFC%, POS (Out of India/as Vendor State) Enter GST Registration Number and fill in the fields including State Code, Code, Description, Input Service Distributor |

Scope of Functionality

- Tax Accounting Period

- Automatic calculation of GST for intrastate and interstate transactions

- State codes and multiple GST registration for company/customer/vendor

- GST posting profile to cater to all transaction scenarios

- GST rate setup in combination with HSN/SAC and GST Group

- Define customer (Registered, un-registered, export, deemed export)

- Define vendor (Registered, un-registered, composite, import, exempted

- Calculate GST on purchase/sale of items, services, charges, and fixed assets

- Compliant with GST reverse charges mechanism

- GST settlement as per the registration number and period

- GST reconciliation for input credit

GST Configuration in Business Central helps simplify taxation and meet regulatory compliance without much hassle. By leveraging the core capabilities of this Microsoft Cloud ERP, business leaders can witness reduced tax evasion, procedural benefits, improved revenue efficiency, and better tax administration. Additionally, connecting to a certified reseller of Business Central License in India, one can set up GST on company information, location, General Ledger, purchase & payables, masters, vendors, customers, service cost, and bank accounts efficiently.

Serving in cloud computing solutions for more than a decade, inoday effectively manages tax configuration with this SaaS solution by Microsoft. We are an accredited Business Central Partner and have won many accolades for our exemplary services, particularly for assisting in maintaining business continuity during the COVID-19 pandemic lockdown.

We are extending our assistance across comprehending upgrade to Business Central from NAV and dedicatedly delivering technology enhancements across all business verticals to help drive lucrative outcomes.

All your other queries and questions would be answered by our dedicated team at +91 120 432 9327 For detailed information, Schedule A Demo!