Table of Contents

With the company’s growth and expansion, accounting becomes more complex. Business administrators would find that entry-level accounting software is limited in its operations. Spreadsheets and disparate accounting software can hardly manage a mature business. Hence, companies often upgrade from QuickBooks to NetSuite. Moreover, QuickBooks are going to be dysfunctional in India and if you have your business units in this region, it’s high time to make a smart business move.

Apart from this, if you want to upgrade your accounting software solution and increase efficiency, you must check NetSuite vs. QuickBooks to understand how both accounting solutions can meet your business requirements.

Both NetSuite and QuickBooks accounting software are engineered to help businesses manage their accounting processes. However, you should pick one that can assist you in reducing operational costs, automating key processes, and increasing productivity.

NetSuite vs. QuickBooks

| QuickBooks is fit for some small businesses.

It helps manage accounting, including managing invoices, paying bills, and basic cash flow tracking. Businesses with bookkeeping requirements and minimal accounting demands can pick QuickBooks. It will generate month and year-end reports and help with annual business taxes. |

NetSuite renders a complete financial management solution.

It increases business efficiency and solves complex accounting issues. Along with NetSuite Accounting, you can get preconfigured KPIs, workflows, reminders, and customizable dashboards to oversee and align key operations and accounting processes. |

For the most part, NetSuite does more.

This cloud accounting software integrates core finance and accounting functions with strong compliance management. You can make the most of real-time access to financial data to dig down into details. NetSuite Accounting helps you quickly generate statements and disclosures that comply with multiple financial regulatory requirements.

NetSuite Features Compare to QuickBooks

Although both accounting software solutions serve similar purposes, a close comparison helps understand fundamental similarities and differences. For growing companies, robustness, completeness of features, and depth of functionality have a direct impact on the time and resources needed to ensure robust financial management.

A recent survey of NetSuite customers says that superior and inventive features and functionality are the primary reasons for CFOs moving from QuickBooks to NetSuite. In case, you want to comprehend NetSuite Vs QuickBooks Pricing, you can consult a certified and award-winning #1 Oracle NetSuite Partner in India—inoday to make a judicious business decision.

Revenue Recognition

NetSuite allows accounting teams to comply with revenue recognition requirements and ascertain automation recognition of scheduled revenue to be recognized automatically. You can have accurate and updated financial statements and forecasts in real time. Software and Services companies offering multiple deliverables such as upgrades, services delivered over time, or additional licenses can make the best of it.

It helps their accounting teams to recognize and defer revenue at different points in time.

On the other hand, QuickBooks can build clever workarounds for the limitations, however, these workarounds generate manual journal entries, complicated recognition schedule spreadsheets, and unclear forward visibility.

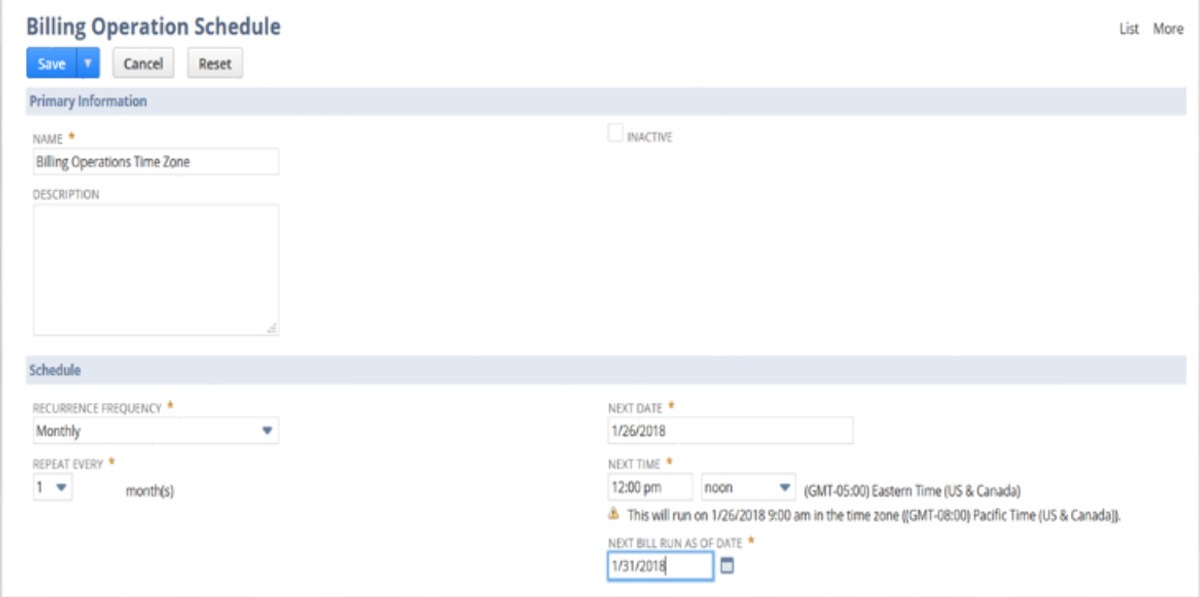

Billing

NetSuite Billing comes with automated renewals to retain revenue and drives real-time visibility into billing and financial activity. When it comes to subscription billing, NetSuite offers consolidated invoicing, and automated rating processes, and supports multiple pricing models to capture setup fees, license counts, and variable consumption in one step.

With this feature, NetSuite overpowers QuickBooks and renders more transparency. Also, it supports multiple subscription billing options, including fixed-rate (annual, multi-year, and monthly), consumption-based, or a combination.

General Ledger

NetSuite’s general ledger (GL) offers accounting data from a consolidated level to individual transactions. This helps businesses customize their General Ledger to meet their business needs. One can add custom GL impact lines to transactions, such as invoices or vendor bills, across single or multiple accounting books. With such capabilities, you can drop down the time and effort needed for account reconciliation, period closing, and audit.

Additionally, the NetSuite Multi-Book engine records all book-specific activity based on a single business transaction from the general ledger, revenue recognition, expense amortization, depreciation, and P&L allocations

QuickBooks tries to do the same with a limited number of tags and they are utilized quickly as users try to implement workarounds.

Accounts Payable

QuickBooks comes with no functionality that renders purchasing controls. It has a limited approval workflow and a few user roles. These capabilities do not deliver a robust control environment and true segmentation of duties.

NetSuite’s approval workflow engine ensures the segregation of duties by offering role-and-user-based permissions. This helps reduce risk by ensuring that approvals are done easily at a time when people aren’t there next to one another. One can drive extensive automation across discount calculation and exception processing and drop down the time it takes to process bills from vendors.

Accounts Receivable

NetSuite’s accounts receivable come with Configurable dashboards, reports, and KPIs to help businesses to manage their customer list, track receivables, and receive payment without entering detailed debits and credits. You can have a real-time view of accounts receivable data such as customer aging, invoice analyses, recurring invoices, deferred revenue, and exception reports.

You can simplify the payment process by offering customers self-service access to real-time insights on purchase orders, inventory levels, and payment information as well.

While going through NetSuite vs. QuickBooks, you need to know that the latter accounting software can create journal entries, but it cannot handle downloads and schedules.

Fixed Asset Management

You can leverage the core capabilities of NetSuite Fixed Asset Management to manage an asset’s complete lifecycle. This functionality helps businesses easily report on all fixed assets, and track depreciating or nondepreciating company assets from creation to depreciation, revaluation, and disposal. You can easily document and maintain an exact record of all capital assets, such as acquisition costs and asset status.

Interestingly, you will not find any such offerings or features with QuickBooks.

Inventory Management

NetSuite inventory management reduces manual processes by driving automation and real-time tracking of inventory levels, orders, and sales throughout the inventory lifecycle. It renders insights needed to make data-driven business decisions, optimize sales, and get more business control. Additionally, it comes with Warehouse management features like inventory counts, pick, pack and ship, integrated barcoding, and multi-order picking, too.

Reporting

Both QuickBooks and NetSuite Accounting Software offer standard accounting reports, such as P&L and cash flow.

However, NetSuite adds more intuitiveness to it with its real-time reports, from revenue forecasting to consolidated parent, and subsidiary reports. Moreover, you can leverage NetSuite’s multicurrency feature to report using the local currency of the countries where legal business entities are located.

Why You Should Choose NetSuite Accounting Software?

As your business grows and expands, your number of customers would definitely increase. You will employ a larger workforce than today, process more data, and for that, you would require more extensive automation.

Here, an accounting software solution that multiplies your business efficiency and solves the purpose of solving mission-critical issues and complex challenges would suit your business the best.

No wonder, company leaders relying on QuickBooks and Excel for accounting had to manually pull monthly depreciation, and amortization reports from spreadsheets. NetSuite Accounting Software is a highly scalable, flexible, and adaptable solution to meet global accounting and compliance standards while providing extensive visibility and transparency at each level.

On the other hand, QuickBooks’ limitations mean businesses companies have to add more applications for specific purposes. Not only do these add costs but disintegrated systems burden finance staff with risks associated with data transfer and consolidation.

You can opt for NetSuite QuickBooks integration as a Fintech company tried. But, they ended up with racked up costs and finally made a move to NetSuite.

Conclusion

As QuickBooks are going to be dysfunctional in India, it is the right high time to move to a more scalable and inventive cloud-based Accounting software solution. Here, NetSuite Accounting stands out to be the most preferred one that drives greater scalability to grow businesses.

Additionally, if you connect with a certified, award-winning, globally praised, #1 Oracle NetSuite Channel Partner like inoday, there would be fewer hassles in reviving your accounting process.

For more details on NetSuite vs. QuickBooks, write to us at info@inoday.com Or Schedule A Demo